Engineered Wood Market Size & Share Analysis

The report covers Global Laminated Veneer Lumber (LVL) Market Size & Trends. The market is segmented by Type (Plywood, Oriented Strand Board (OSB), Glulam, Cross-laminated Timber (CLT), Laminated Veneer Lumber (LVL), Particleboard, and Other Types), Application (Non-residential and Residential), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The report offers market size and forecasts for engineered wood in volume (thousand cubic meters) for all the above segments.

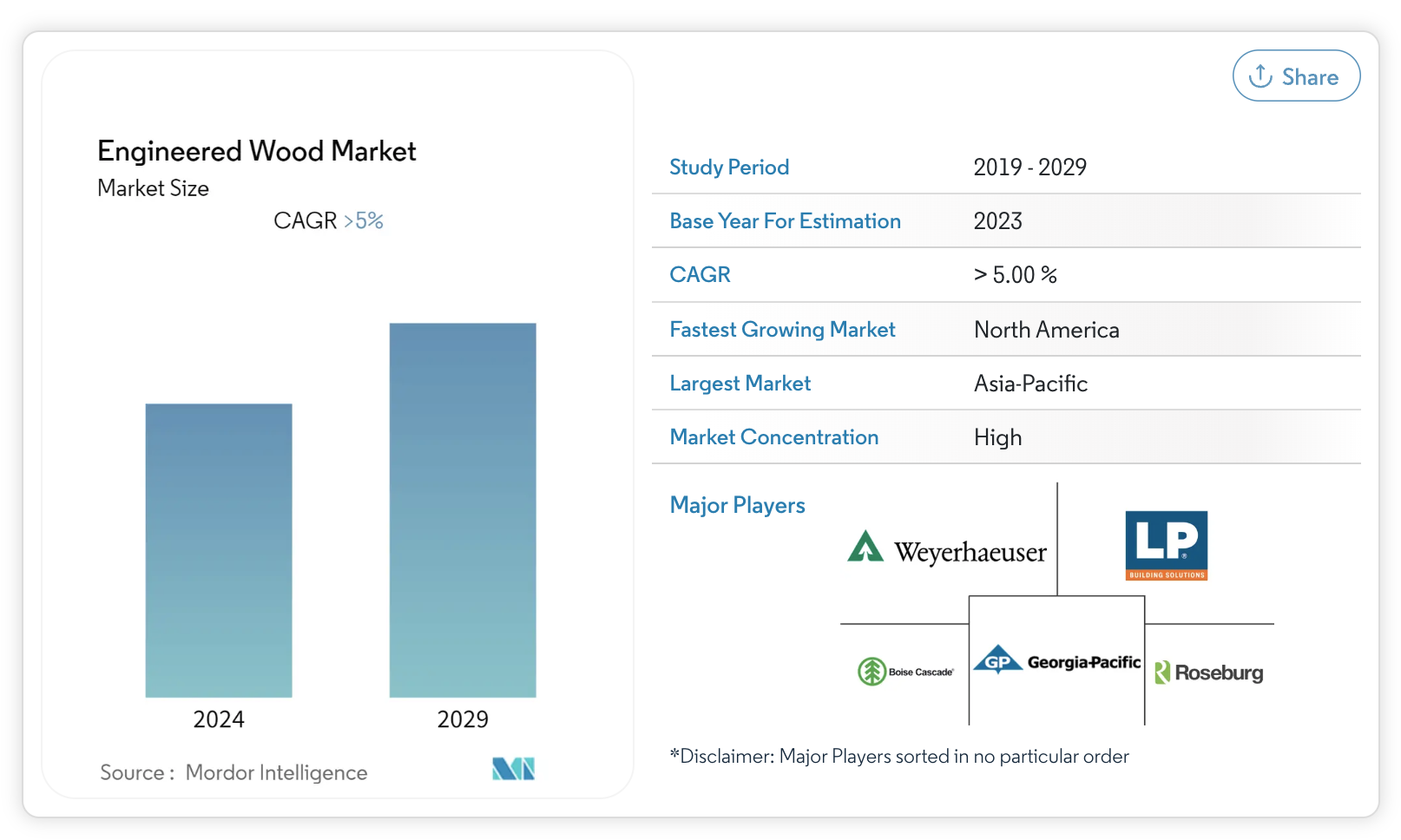

Engineered Wood Market Size

Engineered Wood Market Analysis

The engineered wood market is expected to register a CAGR of over 5% during the forecast period.

The COVID-19 pandemic had a negative impact on the market, however, the market for engineered wood has now been close to reaching pre-pandemic levels because of increasing construction and restoration activities in the post-pandemic period.

- Over the medium term, growing demand from the non-residential sector and increasing use of cross-laminated timber (CLT) as a construction material are likely to drive the market in the forecast period.

- On the flip side, stringent environmental concerns related to formaldehyde emissions are likely to hinder the market growth.

- The growing residential construction in India and China is expected to act as an opportunity in the forecast period.

- The Asia-Pacific region is likely to dominate the global market and is expected to witness the highest consumption of engineered wood during the forecast period.

Engineered Wood Market Trends

This section covers the major market trends shaping the Engineered Wood Market according to our research experts:

Residential Sector to Dominate the Market

- Engineered wood is used for a wide range of applications, including furniture, walls, flooring, doors, roofs, cabinets, columns, beams, and staircases, among others.

- The application of cross-laminated wood has been increasing rapidly. For low-rise construction, the increased loadbearing capacity of CLT wall panels adds further benefits over conventional stud-framed walls.

- Cross-laminated timber is now an established system in the mid-rise residential sector in Europe and North America. In addition to that, there are now increasing examples of cross-laminated timber being used to construct skyscrapers for buildings over 150 meters tall.

- The growing application of OSB in various residential applications, such as walls, flooring, and roofs, is estimated to drive the market.

- All types of engineered woods are significantly used in various applications in the residential sector. With 73% of its population living in urban areas, Europe is expected to be over 80% urban by 2050. European furniture companies are very successful and innovative, examples being the German, Italian, and Nordic furniture companies, which act as a benchmark in the field of high-class design.

- As per data published by US Census Bureau, in the United States, public spending on construction increased significantly in 2021 as compared to 2017. In 2021, the public spending on residential construction was around USD 9.06 billion. This can be attributed to increased spending on residential buildings by the public due to the work-from-home culture in the post-pandemic period.

- Also, in the United States, several residential construction projects are in the pipeline, creating opportunities for increased furniture consumption.

- The Indian government announced an investment worth USD 31,650 billion for the construction of 100 cities under its Smart Cities plan. One hundred smart cities and 500 cities are likely to invite investments worth INR 2 trillion (~USD 28.18 billion) over the coming five years.

- Thus, based on the aforementioned aspects, the residential segment is expected to drive the market in the forecast period.

The Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region has several major countries, such as China, India, ASEAN, and Japan.

- China has been majorly driven by the ample developments in the residential and commercial construction sectors and supported by the growing economy. In China, the housing authorities of Hong Kong launched several measures to push start the construction of low-cost housing. The officials aim to provide 301,000 public housing units by 2030.

- China is also likely to witness the construction of 7,000 more shopping centers which are estimated to be opened by 2025.

- The Indian government initiated the project called ‘Housing for All by 2022’, which is expected to immensely drive the low-cost residential construction segment in the country throughout the forecast period.

- In India, more than 30 hospital projects are under planning or construction. This number includes both expansion and new construction projects. For instance, the Health City hospital project worth US 1.4 million is under construction, which is being built by Care Hospitals in the Visakhapatnam district of Andhra Pradesh.

- In Asia-Pacific, Japan, along with China, has a considerable share of the OSB market. Norbond has been marketing its OSB panels in Japan for over 20 years, and it has established a track record of high performance in a variety of end-user construction.

- In South Korea, some of the upcoming airport constructions are the New Jeju Airport (USD 3.6 billion), the Ulleungdo Island Airport (USD 440 million), and the New Dumaguete Airport. The growing airport construction may add more offices and commercial spaces.

- Hence, the Asia-Pacific region is expected to dominate the global market.

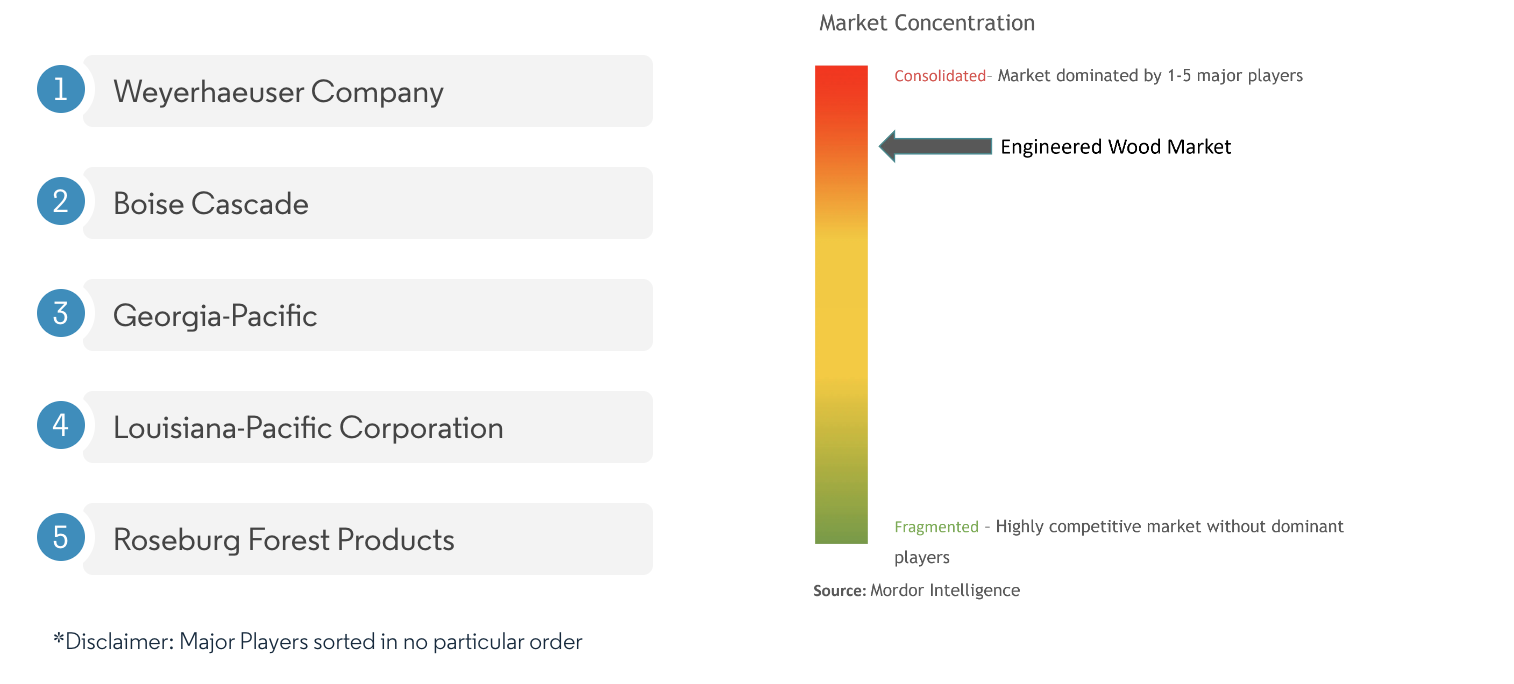

Engineered Wood Industry Overview

The global engineered wood market is partially consolidated, with most players accounting for a marginal market share. Major companies of the market (in no particular order) include Weyerhaeuser Company, Boise Cascade, Georgia-Pacific, Roseburg Forest Products, and Louisiana-Pacific Corporation.

Source: https://www.mordorintelligence.com/industry-reports/engineered-wood-market

Engineered Wood Market Leaders

Engineered Wood Market News

- In December 2022: Boise Cascade expanded distribution centers in two new markets by acquiring of 45-acres in Walterboro, SC, and purchase of a 34-acre land parcel in Hondo, Texas.

- In October 2022: Boise Cascade announced the expansion of its distribution center through the acquisition of 4.67 acres of land adjacent to its Albuquerque, New Mexico branch.

- In February 2021: Norbord Inc. was acquired by West Fraser, which is a diversified wood products company producing lumber, LVL (laminated veneer lumber), MDF (medium-density fiberboard), plywood, pulp, newsprint, wood chips, other residuals, and energy with facilities in western Canada and the southern US.

Engineered Wood Industry Segmentation

Engineered wood is a man-made wood product manufactured by binding strands, fibers, and wood chips with adhesives to make composite wood structures. The market is segmented based on type, application, and geography. By type, the market is segmented into plywood, oriented strand board (OSB), glulam, cross-laminated timber (CLT), laminated veneer lumber (LVL), particleboard, and other types. By application, the market is segmented into non-residential and residential. The report also covers the market size and forecasts for the engineered wood market in 15 countries across major regions. For each segment, the market sizing and forecasts have been done based on volume (thousand cubic meters).

| Application | |

| Non-residential | |

| Residential |

| Type | |

| Plywood | |

| Oriented Strand Board (OSB) | |

| Glulam | |

| Cross-laminated Timber (CLT) | |

| Laminated Veneer Lumber (LVL) | |

| Particleboard | |

| Other Types |

| Geography | |||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

Engineered Wood Market Research FAQs

What is the current Engineered Wood Market size?

The Engineered Wood Market is projected to register a CAGR of greater than 5% during the forecast period (2024-2029)

Who are the key players in Engineered Wood Market?

Weyerhaeuser Company , Boise Cascade, Georgia-Pacific, Louisiana-Pacific Corporation and Roseburg Forest Products are the major companies operating in the Engineered Wood Market.

Which is the fastest growing region in Engineered Wood Market?

North America is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Engineered Wood Market?

In 2024, the Asia-Pacific accounts for the largest market share in Engineered Wood Market.

What years does this Engineered Wood Market cover?

The report covers the Engineered Wood Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Engineered Wood Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Know More

Timber in construction roadmap

Construção em Madeira,Porquê escolher madeira?

Government has introduced a statutory tree and woodland cover target which commits to increasing the tree canopy and woodland cover in England to 16.5% by 2050. But not only do we need to plant trees, we also need to make good use of the materials they provide to us.

O futuro da construção em madeira

A multiplicidade de materiais de construção à base de madeira abre uma vasta gama de possibilidades para os construtores de casas. Embora o método convencional de construção em betão, principalmente, aço ou alvenaria ainda dominem, cada vez mais projetos feitos de madeira são construídos todos os anos.

O Comportamento da Madeira ao Sismo

Artigos,Construção em Madeira,Porquê escolher madeira?

A madeira é um material com um excelente comportamento sísmico. É leve, os seus elementos construtivos apresentam grande capacidade de deformação e são sistemas de grande redundância.